Taxes that come out of paycheck

On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. See how your refund take-home pay or tax due are affected by withholding amount.

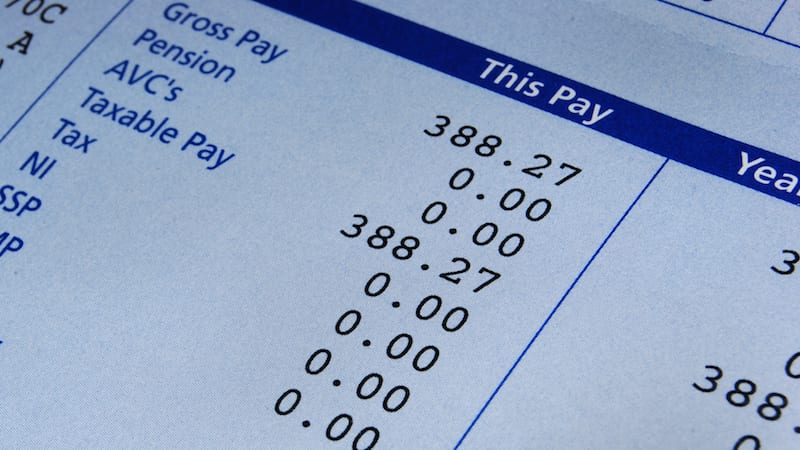

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

America uses a progressive system in determining what employees pay in income tax.

. Some states follow the federal tax. Your employer will withhold money from each of. 10 hours agoIndividuals will receive a 50 income tax rebate.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. On the one hand the first FICA tax is the Social Security tax consisting of a total of 62 of your gross pay. You didnt earn enough money for any tax to be withheld.

Texas tax year starts from July 01 the year before to June 30 the current year. The first wave of rebate checks were sent out Monday. Meanwhile the second tax of this type is the Medicare tax.

CHICAGO Roughly six million Illinois taxpayers will soon get a one-time income and property tax rebate. When you file your tax. Texas state income tax.

Use this tool to. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. This means that the amount required by the government is smaller for.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. How It Works.

Couples will receive 100. The Tax Foundation predicts that the average American will owe roughly 500 on 10000 student loan forgiveness and 1000 on 20000 student loan forgiveness. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out.

The rebate is also worth 100 per dependent claimed on your 2021 taxes for up to three. Estimate your federal income tax withholding. If no federal income tax was withheld from your paycheck the reason might be quite simple.

These are contributions that you make before any taxes are withheld from your paycheck. For a single filer the first 9875 you earn is taxed at 10. The state tax year is also 12 months but it differs from state to state.

4 hours agoLAS VEGAS KTNV On Wednesday three women got services at Lashes Polished nail spa off Rainbow Sahara and then walked out not paying their nearly 200. If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on. An example of how this works.

Only the very last 1475 you. So the tax year 2021 will start from July 01 2020 to June 30 2021. The current rate for Medicare is 145 for the employer and 145.

Different Types Of Payroll Deductions Gusto

Paycheck Calculator Take Home Pay Calculator

Irs New Tax Withholding Tables

What Are Payroll Deductions Article

What Are Employer Taxes And Employee Taxes Gusto

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Paycheck Taxes Federal State Local Withholding H R Block

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Calculator Take Home Pay Calculator

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Understanding Your Paycheck Credit Com

Tax Information Career Training Usa Interexchange

Understanding Your Paycheck

Understanding Your Teacher Paycheck We Are Teachers

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Paycheck Calculator Online For Per Pay Period Create W 4